Bond exchange-traded funds (ETFs) just invest in bonds and tend to duplicate their price performance on the index. Kavan Choksi marks that bond ETFs are very specific financial vehicles that expose investors to fixed-income assets. These ETFs trade on the stock exchange, and can be bought and sold at actual market value. As they track a particular index, bond ETFs are known to be passively managed instruments.

Kavan Choksi mentions the beneficial aspects of including bond ETFs to the investment portfolio

Bond ETFs are passive funds that have the added benefit of low cost and easy liquidity. Unlike the typical open-ended bond mutual funds, bond ETFs trade on the exchange at a much lower price in comparison to actively managed funds throughout the day. They closely mirror the index and help investors to buy and sell while investing in fixed-income assets. There are a number of advantages of bond ETFs that makes them a good addition to the investment portfolio.

- Easy trading: Much like any other ETFs, bond ETFs can be traded in the open markets in ease in real-time through brokers or the online trading portals

- Low risk investment: Bonds are low risk products that provide the benefit of fixed income. Bond ETFs are also considered to be low risk products like their underlying index, as they tend to have the advantage of debt funds. On the account of being ETF products, they enjoy further reduced risk.

- Transparency: Price transparency is not a concern with bond ETFs. Investors can get the price details of bond ETFs in real time as they are traded in the open market. In fact, their prices are updated every few seconds during market hours.

- Reduced cost: Being passively managed funds, the cost of investment or the expense ratio of bond ETFs are much lower in comparison to other types of investments.

- Diversified portfolio: Bond ETFs provide the advantage of holding multiple debt instruments or bonds on any bond index in a single unit of the ETF. This offers a diversified portfolio to the investors at an expense much lower than that of holding individual bonds.

- Liquidity: Bonds generally are not liquid and are not traded in the secondary market. But this problem is resolved in bond ETFs by effectively compiling some of the largest and the most liquid bonds to ensure high liquidity, along with the ability to trade in open markets in real time.

Kavan Choksi mentions that investors who follow the asset allocation theory must especially choose to put their money in bond ETFs. This financial instrument can provide consistent income and stability during weak markets and economic downturns. Having some allocation of bond ETFs in their portfolio can also be a good idea for investors who cannot or do not want to deal with the volatility of the stock market. Even though equities have outperformed bonds in the long run, there are many investors who tend to be unwilling to accept the downside risk of the stock market when it falls. But investing in bond ETFs can actually help them to reduce a bit of the element of risk in their portfolio.

The Smart Manager’s Guide: Blending Competitive Intelligence with Employee Monitoring

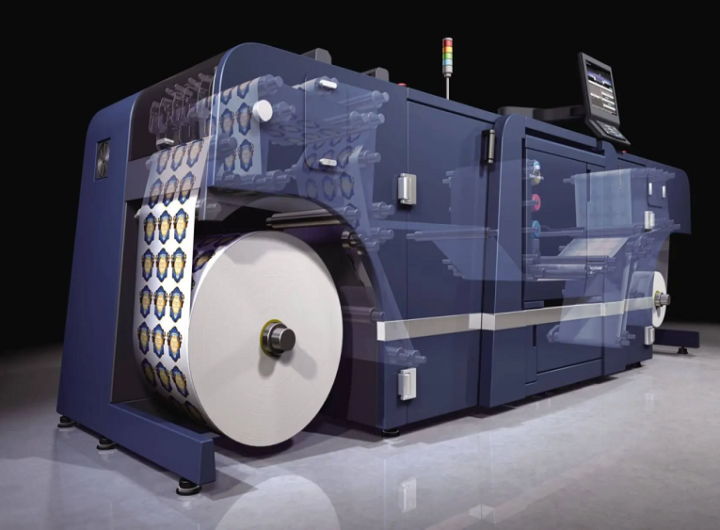

The Smart Manager’s Guide: Blending Competitive Intelligence with Employee Monitoring  How Do Custom Stickers & Digital Labels Improve Packaging?

How Do Custom Stickers & Digital Labels Improve Packaging?  Why You Need a Demat Account for Investing: Key Benefits Unveiled

Why You Need a Demat Account for Investing: Key Benefits Unveiled  Essential Preschool Gear: Heavy-Duty Clear Backpacks and Customized Luggage Tags

Essential Preschool Gear: Heavy-Duty Clear Backpacks and Customized Luggage Tags  A Beginner’s Guide On How You Should Do Commodity Trading

A Beginner’s Guide On How You Should Do Commodity Trading  Quantitative trading and algorithmic trading in the stock market

Quantitative trading and algorithmic trading in the stock market  Trek Nepal’s Four Great Regions: Annapurna, Langtang, Manaslu, and Nar Phu:

Trek Nepal’s Four Great Regions: Annapurna, Langtang, Manaslu, and Nar Phu:  The Ecosystem of Ease: How Bill Payments Evolved into a Digital Habit

The Ecosystem of Ease: How Bill Payments Evolved into a Digital Habit  How Insurance Apps Are Embedding Themselves Into India’s Daily Payment Flows

How Insurance Apps Are Embedding Themselves Into India’s Daily Payment Flows  A Guide to the Best Things to Do Near Villa Firenze Costa Rica

A Guide to the Best Things to Do Near Villa Firenze Costa Rica