In today’s digital age, investing in the stock market has become more accessible than ever before. One crucial requirement for investing in stocks, mutual funds, and other securities is having a dematerialized (demat) account. This article explores the significance and the ways to open demat account and unveils the key benefits it offers to investors.

Safe and Secure Holdings: Opening a demat account ensures the safety and security of your investments by eliminating the need for physical share certificates. Securities are held in an electronic format, reducing the risk of loss, damage, or theft of physical certificates. When you open demat account, you can have peace of mind knowing that your holdings are stored securely in digital form.

Easy and Convenient Trading: A demat account simplifies the trading process and makes it more convenient for investors. Through online trading platforms associated with demat accounts, investors can buy and sell securities with just a few clicks. This eliminates the need for paperwork and physical presence at stock exchanges, allowing investors to trade from the comfort of their homes or offices. The ease and convenience of trading through a demat account save time and effort. This is why you need to open demat account online or offline.

Seamless Transfer of Securities: One of the key benefits of a demat account is the quick and hassle-free transfer of securities. Whether you want to transfer shares to another demat account or receive shares through a corporate action like bonus issues or rights offerings, the process is seamless. Thus you need to open demat account. Electronic transfer of securities ensures speedy and efficient transactions, reducing the time and effort involved in physical transfers.

Access to a Wide Range of Financial Instruments: With a demat account, investors gain access to a diverse range of financial instruments beyond just stocks. These include mutual funds, exchange-traded funds (ETFs), bonds, government securities, and more. By diversifying their investment portfolio across various asset classes, investors can manage risk and capitalize on different market opportunities.

Automated Dividend and Interest Payments: Owning a demat account simplifies the process of receiving dividend and interest payments. When you hold shares of dividend-paying companies or invest in interest-bearing instruments like bonds, the payments are credited directly to your demat account. This eliminates the need for physical checks or vouchers and ensures timely and accurate receipt of your earnings thus its important to check to open demat account.

Easy Monitoring and Tracking of Investments: A demat account provides investors with a consolidated view of their holdings, making it easier to monitor and track investments. Online platforms associated with demat accounts offer real-time updates on stock prices, portfolio performance, and transaction history. This enables investors to make informed decisions based on accurate and up-to-date information.

Loan Against Securities: Another valuable benefit of a demat account is the ability to avail loans against securities held in the account. Banks and financial institutions offer loans against shares, mutual funds, and other eligible securities, providing liquidity to investors when needed. This feature allows investors to unlock the value of their holdings without selling them.

The Smart Manager’s Guide: Blending Competitive Intelligence with Employee Monitoring

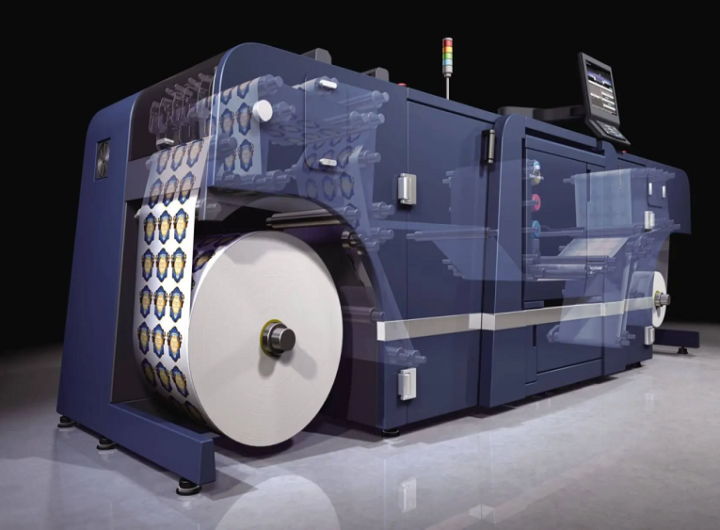

The Smart Manager’s Guide: Blending Competitive Intelligence with Employee Monitoring  How Do Custom Stickers & Digital Labels Improve Packaging?

How Do Custom Stickers & Digital Labels Improve Packaging?  Essential Preschool Gear: Heavy-Duty Clear Backpacks and Customized Luggage Tags

Essential Preschool Gear: Heavy-Duty Clear Backpacks and Customized Luggage Tags  A Beginner’s Guide On How You Should Do Commodity Trading

A Beginner’s Guide On How You Should Do Commodity Trading  Quantitative trading and algorithmic trading in the stock market

Quantitative trading and algorithmic trading in the stock market  Kavan Choksi Discusses Why it is a Good Idea for Investors to Have Some Allocation of Bond ETFs in Their Portfolio

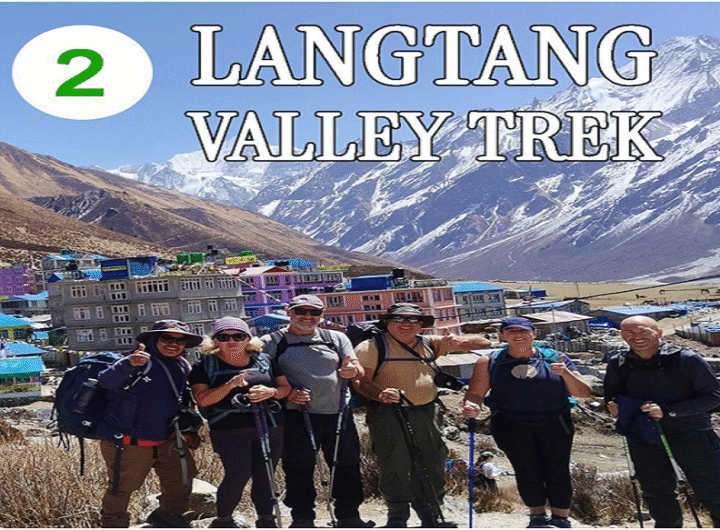

Kavan Choksi Discusses Why it is a Good Idea for Investors to Have Some Allocation of Bond ETFs in Their Portfolio  Complete Trekking Guide to Langtang and Annapurna

Complete Trekking Guide to Langtang and Annapurna  Trek Nepal’s Four Great Regions: Annapurna, Langtang, Manaslu, and Nar Phu:

Trek Nepal’s Four Great Regions: Annapurna, Langtang, Manaslu, and Nar Phu:  The Ecosystem of Ease: How Bill Payments Evolved into a Digital Habit

The Ecosystem of Ease: How Bill Payments Evolved into a Digital Habit  How Insurance Apps Are Embedding Themselves Into India’s Daily Payment Flows

How Insurance Apps Are Embedding Themselves Into India’s Daily Payment Flows