Are you a beginner and want to start with commodity trading? But unluckily you don’t have any idea about it, no problem at all. As we are here to provide you with an amazing, detailed, understandable guide which explains what commodity training is and what are the necessary steps you need to follow as a beginner in commodity trading.

Without any delay let’s dive into this guide to get into commodity trading without any hesitation.

What is Commodity Trading?

Commodity trading involves buying and selling raw materials or primary products such as metals, energy, agricultural products, and other commodities. The commodities market allows producers and buyers to hedge against the risk of price fluctuations by locking in prices for future delivery. The commodities market is influenced by a variety of factors, such as supply and demand, geopolitical events, weather patterns, and other economic indicators.

Commodity trading is an essential part of the global economy, and it can offer opportunities for profits and risks for traders. Commodity traders can be individuals, financial institutions, or companies that specialise in buying and selling commodities in the global marketplace. These traders take advantage of price volatility in the market by speculating on future price movements, buying low and selling high.

Steps to do Commodity Trading for Beginners:

Commodity trading can be a complex and challenging process, but with the right knowledge and approach, it can also be a lucrative and exciting venture. Here are some key steps to consider when getting started with commodity trading:

1. Understand the basics of commodity trading:

Before getting into trading, it is essential to have a good understanding of the fundamentals of commodity trading. You should learn about the different types of commodities, their prices, and how they are traded. You can find a lot of resources online or consider taking a course to deepen your knowledge.

2. Determine your trading strategy:

Once you have a solid understanding of commodity trading, you need to decide on your trading strategy. This will depend on your risk tolerance, investment goals, and trading experience. Some popular strategies include trend following, mean reversion, and fundamental analysis.

3. Choose a commodity broker:

To start trading, you need to work with a commodity broker. Make sure you choose a reputable broker with a good track record. Research their fees, trading platform, and customer support.

4. Open a trading account:

After choosing a broker, you need to open a trading account. This involves filling out an application and providing documentation to verify your identity. You may also need to deposit funds to start trading. Commodity traders open demat account as well to store trade information.

5. Monitor the markets:

Once your account is set up, you can start monitoring the markets and looking for opportunities to trade. Keep an eye on commodity prices, news events, and market trends. When you are ready to make a trade, enter the order into your trading platform. Be sure to double-check the details, including the quantity, price, and order type.

6. Manage risk:

Commodity trading can be volatile, so it is essential to manage your risk carefully. Use stop-loss orders to limit your losses, and always have a plan in place for exiting a trade if it goes against you.

7. Review and refine your strategy:

Finally, it’s important to review your trading performance regularly and refine your strategy as needed. Keep a trading journal to record your trades and analyse your results.

By following the adobe mentioned steps you can for sure start a commodity easily with proper guidance and succeed in that as well.

The Smart Manager’s Guide: Blending Competitive Intelligence with Employee Monitoring

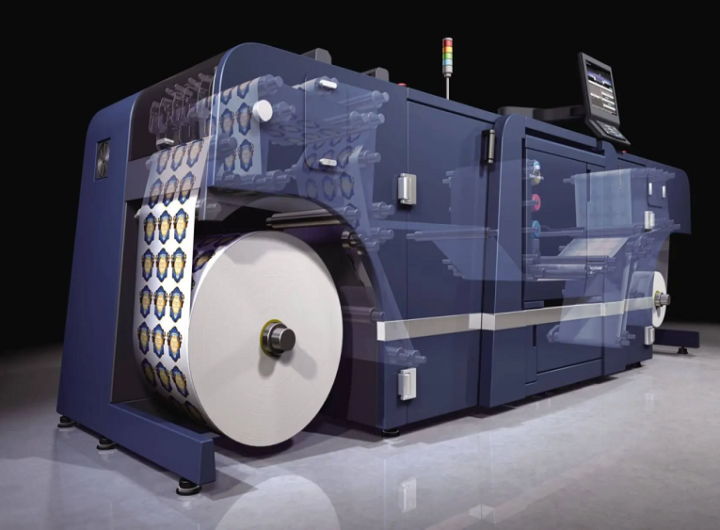

The Smart Manager’s Guide: Blending Competitive Intelligence with Employee Monitoring  How Do Custom Stickers & Digital Labels Improve Packaging?

How Do Custom Stickers & Digital Labels Improve Packaging?  Why You Need a Demat Account for Investing: Key Benefits Unveiled

Why You Need a Demat Account for Investing: Key Benefits Unveiled  Essential Preschool Gear: Heavy-Duty Clear Backpacks and Customized Luggage Tags

Essential Preschool Gear: Heavy-Duty Clear Backpacks and Customized Luggage Tags  Quantitative trading and algorithmic trading in the stock market

Quantitative trading and algorithmic trading in the stock market  Kavan Choksi Discusses Why it is a Good Idea for Investors to Have Some Allocation of Bond ETFs in Their Portfolio

Kavan Choksi Discusses Why it is a Good Idea for Investors to Have Some Allocation of Bond ETFs in Their Portfolio  Complete Trekking Guide to Langtang and Annapurna

Complete Trekking Guide to Langtang and Annapurna  Trek Nepal’s Four Great Regions: Annapurna, Langtang, Manaslu, and Nar Phu:

Trek Nepal’s Four Great Regions: Annapurna, Langtang, Manaslu, and Nar Phu:  The Ecosystem of Ease: How Bill Payments Evolved into a Digital Habit

The Ecosystem of Ease: How Bill Payments Evolved into a Digital Habit  How Insurance Apps Are Embedding Themselves Into India’s Daily Payment Flows

How Insurance Apps Are Embedding Themselves Into India’s Daily Payment Flows