Quantitative trading and algorithmic trading are two popular strategies used in the stock market to make investment decisions based on data-driven analysis and mathematical models. These strategies aim to automate the decision-making process and increase efficiency in the stock trading market.

Quantitative stock trading involves using statistical and mathematical models to identify patterns and trends in stock prices, trading volume, and other market data. This approach relies heavily on data analysis and often involves the use of complex algorithms and computer programs to identify trading opportunities. Quantitative traders may use a variety of techniques such as technical analysis, fundamental analysis, and statistical arbitrage to make investment decisions in your demat account.

Algorithmic trading, on the other hand, is a subset of quantitative trading that involves using computer programs to execute trades based on predefined rules and algorithms. These algorithms are designed to identify specific market conditions and execute trades automatically, without the need for human intervention. Algorithmic traders often use sophisticated algorithms and high-frequency trading strategies to capitalize on market movements in real time with the help of a demat account.

One of the main advantages of quantitative and algorithmic stock trading is their ability to process large amounts of data quickly and accurately. These strategies can analyze vast amounts of market data in real-time and make investment decisions based on objective analysis rather than emotion or intuition. This approach can help reduce the impact of human biases on investment decisions and improve the consistency and efficiency of the trading process.

Another advantage of these strategies is their ability to operate 24/7. Unlike human traders who need to take breaks and sleep, algorithms and computer programs can trade around the clock, taking advantage of market opportunities as they arise. This can help maximize returns and reduce the risk of missing out on profitable trades with stock trading methods.

However, there are also some risks and challenges associated with quantitative and algorithmic trading. One of the main challenges is the need for accurate and reliable data. These strategies rely heavily on data analysis, and any errors or inaccuracies in the data can lead to incorrect investment decisions. Additionally, the algorithms and models used in quantitative and algorithmic trading may not always be able to account for unexpected market events or changes in market conditions. This can lead to losses in stock trading.

Another challenge is the potential for algorithmic trading to contribute to market volatility. High-frequency trading algorithms can execute trades in milliseconds, which can lead to sudden and significant market movements. This can create a feedback loop, where market movements trigger more trades, leading to further market movements. As a result, the market for demat accounts can become volatile and destabilized.

In summary, quantitative and algorithmic trading are popular strategies used in the stock market to make investment decisions based on data-driven analysis and mathematical models. These strategies can offer many advantages, including increased efficiency, consistency, and the ability to operate 24/7 in stock trading.

The Smart Manager’s Guide: Blending Competitive Intelligence with Employee Monitoring

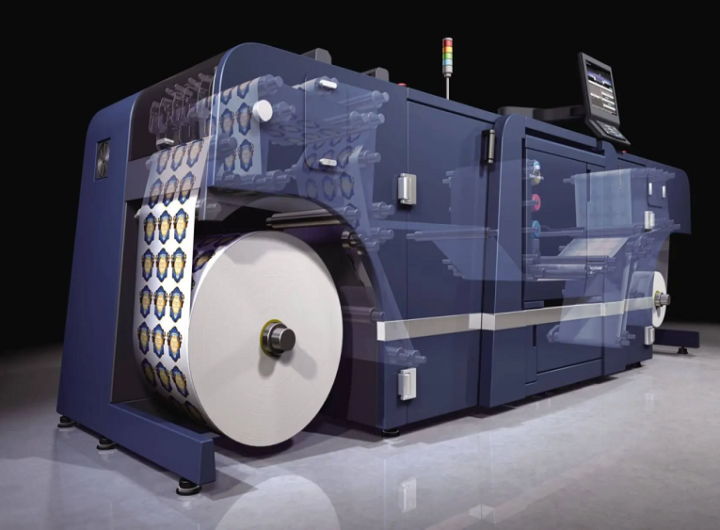

The Smart Manager’s Guide: Blending Competitive Intelligence with Employee Monitoring  How Do Custom Stickers & Digital Labels Improve Packaging?

How Do Custom Stickers & Digital Labels Improve Packaging?  Why You Need a Demat Account for Investing: Key Benefits Unveiled

Why You Need a Demat Account for Investing: Key Benefits Unveiled  Essential Preschool Gear: Heavy-Duty Clear Backpacks and Customized Luggage Tags

Essential Preschool Gear: Heavy-Duty Clear Backpacks and Customized Luggage Tags  A Beginner’s Guide On How You Should Do Commodity Trading

A Beginner’s Guide On How You Should Do Commodity Trading  Kavan Choksi Discusses Why it is a Good Idea for Investors to Have Some Allocation of Bond ETFs in Their Portfolio

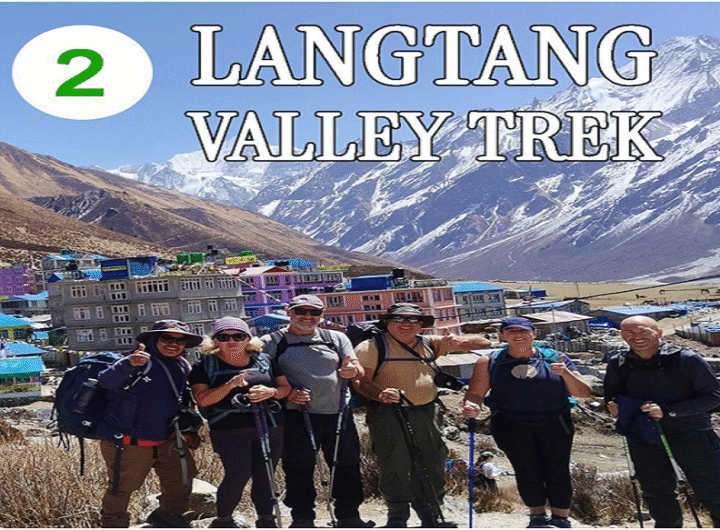

Kavan Choksi Discusses Why it is a Good Idea for Investors to Have Some Allocation of Bond ETFs in Their Portfolio  Complete Trekking Guide to Langtang and Annapurna

Complete Trekking Guide to Langtang and Annapurna  Trek Nepal’s Four Great Regions: Annapurna, Langtang, Manaslu, and Nar Phu:

Trek Nepal’s Four Great Regions: Annapurna, Langtang, Manaslu, and Nar Phu:  The Ecosystem of Ease: How Bill Payments Evolved into a Digital Habit

The Ecosystem of Ease: How Bill Payments Evolved into a Digital Habit  How Insurance Apps Are Embedding Themselves Into India’s Daily Payment Flows

How Insurance Apps Are Embedding Themselves Into India’s Daily Payment Flows