Imagine this: You own a marketing agency, and while you are busy micromanaging your team’s daily activities, your biggest competitor launches a game-changing campaign that takes a significant portion of clients away from you. Sounds familiar? I’ve been there, and it taught me the difference between monitoring employees and strategically using that information alongside competitive intelligence.

Most businesses tend to separate executive monitoring systems from other forms of intelligence that revolve around employees. But here’s the key insight—integrating these two powerful elements not only improves team management but also creates an agility-based competitive advantage that propels consistent growth for sustained market leadership.

The Current Landscape of Employee Monitoring

Let us start with some facts that paint a bleak picture. Resume Builder research shows four out of five companies tracking office attendance have seen a substantial rise. This is just a fraction of the employee time tracking apps like Controlio for evolution in the form of basic punch-in cards or simple attendance logs and distance measures.

Traditional Methods of Monitoring

- Monitoring attendance and schedules

- Project management tools

- Basic productivity tracking

- Automating screen capture and logging keystrokes

Advanced Methods Integrating Intelligence

- Metrics defined by the best performance in a field or industry

- Analysis of workflows between competitors

- Assignment of specific tasks driven by market activity

- Adapting to competitor actions in real-time

The difference? Smart companies aren’t just collecting intel; they’re strategically using it to give them a leg up on their competition.

How Competitive Intelligence Impacts Your Group

Competitive intelligence isn’t unethical spying. It is knowing the area and the environment such that good decisions are made regarding where to put focus with the energy of your team.

While implementing competitive intelligence at my previous job, I was blown away by what we found out. Our main competitor was spending more than 60% more time than us on social media engagement, and they definitely saw better client retention as a result. This insight not only changed our strategy but also how we restructured our team’s daily task allocations.

Key Components of Competitor Intelligence

- Marketing and communication practices

- Pricing strategies and offered services

- Process improvement methods

- Technology utilization trends

- Focus areas in professional development

The Tools Work Better Together: The Strategic Marriage

This is the interesting part: combining these forms together as a basic employee surveillance system, which monitors “what certain teams do,” with competitive intelligence, forming a potent blend.

Illustrated Case Study Applying Theory

Imagine that your content creation group engages in an idle video production rate of forty percent while performing blog writing at twenty percent. Concurrently, your competitor analysis identifies that competitors vying for 300% better engagements with several players among the top three heavy spenders on videos are competing aggressively. With this information, you can take effective action.

- Shift staff schedules to boost production of video content.

- Content creators should undergo video editing workshops.

- Establish new productivity goals based on competitors.

- Evaluate the impact of these adjustments using advanced analysis tools.

Addressing Employee Privacy and Trust Issues

Let’s get straight to it: employee privacy and trust issues. I’ve witnessed businesses try to implement tracking systems that turned workplaces into surveillance zones where employees were under constant monitoring instead of being genuinely cared for by their employers. Purpose-driven frameworks explain why monitoring matters strategically.

Shaping Trust Through Transparency

Do:

- Monitoring should have a clearly defined goal that is communicated to all employees without obfuscation.

- Focus on cross-discipline or departmental workflow improvement instead of micromanagement, e.g., optimization pathways for improved output in set tasks or streams.

- Data showing resource allocation, such as workload distribution, should be shared with employees, highlighting its equitable nature alongside trust restoration features.

- Data collected privately must not involve personal aspects, such as work emails, and data watched over should ensure collective trust, not privacy breaches, through holistic evaluation showing trends and patterns while avoiding granular focus on ‘who.’

Don’t:

- Put systems in place meant to track workflows without giving a comprehensible framework explaining ‘why.’

- Use the collected resources aiming towards improving overall company strategy if misplaced aims lead towards individual productivity punishment systems instead of incentives like rewarding initiatives, not focusing multiplicatively on reduction beyond expectation levels achieved previously.

- Eavesdrop beyond professional interests suspended during employee downtime (like videos).

- Foster shared environments marked by continuous observation geared mainly at noting behavior instead of interaction function, resulting in voiding productivity boosts potential.

This exemplifies balance with a top time tracking app like Controlio, balancing valuable insight while retaining dignity-trust-enhancing frameworks evenly throughout processes.

Actionable Planning Techniques

Here is a step-by-step method that, in my experience working with businesses to adopt these systems, yields fruitful results:

Phase 1: Forming a Foundation (Weeks 1-2)

- Conduct team briefing sessions for communicating the overarching vision.

- Establish clear privacy regulations and limits.

- Set up advanced monitoring systems.

- Start collecting intelligence data on competitors.

Phase 2: Evaluation and Integration (Weeks 3-6)

- Systematically combine internal productivity metrics with external market data.

- Define areas for improvement concerning workflow efficiency.

- Change employee focus to align with current competitive shifts.

- Deliver additional workshops where knowledge gaps have been addressed.

Phase 3: Ongoing Strategic Improvement

- Periodic market SWOT analysis review.

- Ongoing optimization of operations and processes.

- Internal performance evaluations against KPIs.

- Growth strategies aligned to industry needs.

Tracking Progress: Metrics Analysis and Reporting

Productivity improvements are great, but positioning your brand strategically in the market enhances visibility even further. Here’s why these factors matter:

Quantitative Measurements

- Reduction in time taken to develop a product.

- Time taken to respond accelerates as competition increases—becomes more responsive to proactive competitors’ launches.

- A more optimized method of organizing resources leads to better results.

- Better feedback from clients relative to other competing firms.

Qualitative Indicators

- Employee participation levels responding to plans put forward.

- Responses coming from adapting infused change by setting outside benchmarks encourage novel thinking, output, and branding strategies.

- Competitive benefits are sustained over long periods, making them weakly defendable while exposing tangible trade advantages accrued abroad through policy actions with longer lead times.

Planning Ahead: Future Visions for Meta Monitoring

Successful companies actively monitor competition because they deploy assets, assign structured intel fusion, and source teams across an ecosystem matrix while transforming documents into resource streams.

This is less about putting more hours in and more about being strategic and working intelligently.

In the future, the combination of AI-powered competitive insights and advanced employee tracking will be crucial. Organizations that succeed in this dual approach will have a great head start in securing exceptional employees and sharpening market performance agility.

Conclusive Remarks: Defining Unbounded Business Potential

Grabbing external opportunities with internal capabilities seamlessly integrated gives organizations a winning edge. Leveraging intelligent monitoring puts companies one step ahead of the competition by providing well-rounded value propositions that go beyond simple team leadership. Together, these blend into a distinct offering, creating true shared value for all stakeholders involved, leveraging competitive advantage.

Striking that ideal balance ensures responsive nimbleness void of micromanagement while inspiring team members at every level, driving company ecosystem adaptability, and fueling business goals. Each individual onboard plays an invaluable role in team success, restructuring drives spinning wheels towards optimized output, snowballing widespread corporate triumphs when leveraged fully from the operations floor, and harnessing systematized efficiency.

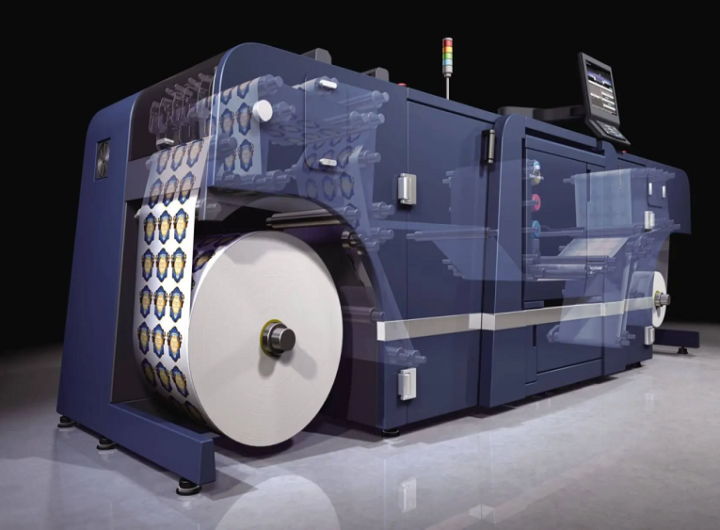

How Do Custom Stickers & Digital Labels Improve Packaging?

How Do Custom Stickers & Digital Labels Improve Packaging?  Why You Need a Demat Account for Investing: Key Benefits Unveiled

Why You Need a Demat Account for Investing: Key Benefits Unveiled  Essential Preschool Gear: Heavy-Duty Clear Backpacks and Customized Luggage Tags

Essential Preschool Gear: Heavy-Duty Clear Backpacks and Customized Luggage Tags  A Beginner’s Guide On How You Should Do Commodity Trading

A Beginner’s Guide On How You Should Do Commodity Trading  Quantitative trading and algorithmic trading in the stock market

Quantitative trading and algorithmic trading in the stock market  Kavan Choksi Discusses Why it is a Good Idea for Investors to Have Some Allocation of Bond ETFs in Their Portfolio

Kavan Choksi Discusses Why it is a Good Idea for Investors to Have Some Allocation of Bond ETFs in Their Portfolio  Complete Trekking Guide to Langtang and Annapurna

Complete Trekking Guide to Langtang and Annapurna  Trek Nepal’s Four Great Regions: Annapurna, Langtang, Manaslu, and Nar Phu:

Trek Nepal’s Four Great Regions: Annapurna, Langtang, Manaslu, and Nar Phu:  The Ecosystem of Ease: How Bill Payments Evolved into a Digital Habit

The Ecosystem of Ease: How Bill Payments Evolved into a Digital Habit  How Insurance Apps Are Embedding Themselves Into India’s Daily Payment Flows

How Insurance Apps Are Embedding Themselves Into India’s Daily Payment Flows